Contact Telephone Numbers

Our telephone numbers are being ported to a new provider, a process which we have been advised may take a few weeks. While the porting is in process, the numbers will ring, but will NOT connect to our phone system so we will NOT recieve the call and therefore will NOT be able to answer

Bringing your UK Car When Moving from the UK to Spain – What You Need to Know

If you’re planning on making a permanent move from the UK to Spain, one practical (and often emotional) decision is whether to bring your UK car with you. While some assume it’s easier to sell their vehicle and buy a Spanish car on arrival, the reality is that in many cases, bringing your UK car

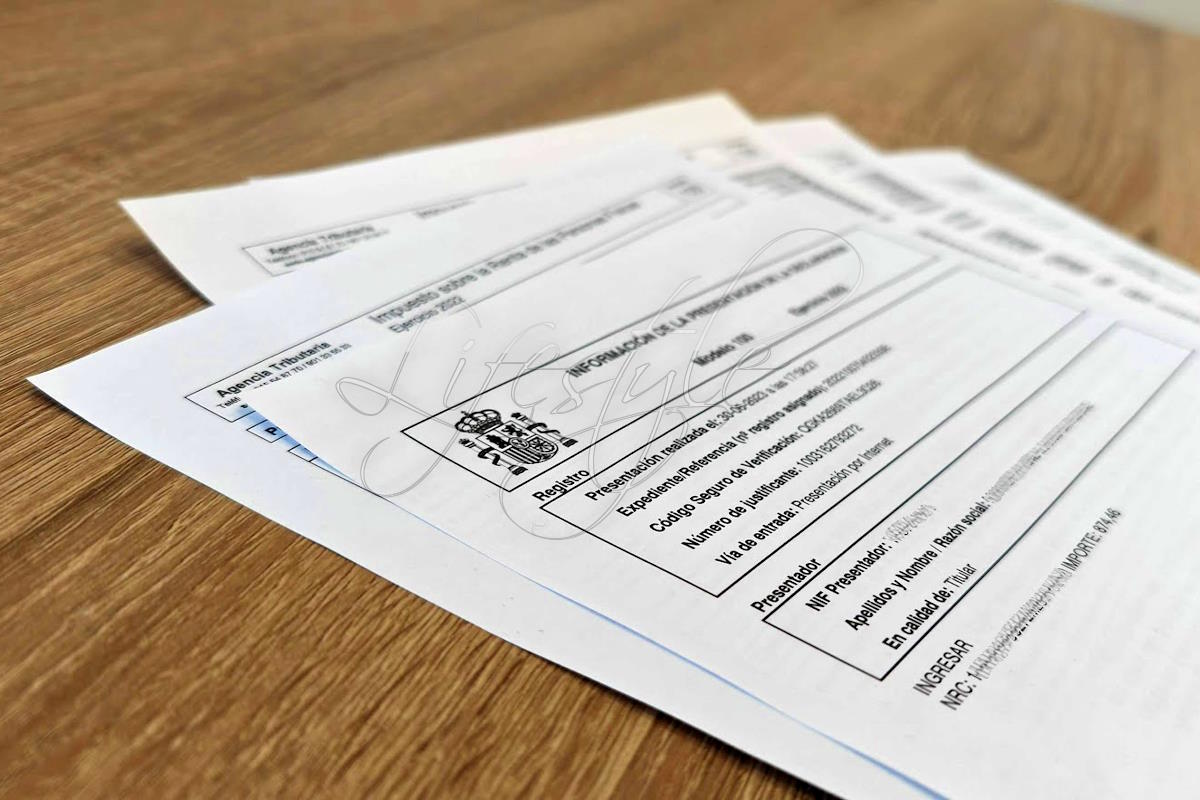

Declaracion de la Renta – Personal Income Tax Return

The ‘declaracion de la renta’ is the personal income tax return in Spain. It is completed by filing the Modelo 100 tax declaration form. Who has to File a Declaracion de la Renta Personal income Tax Return in Spain All Spanish residents are obliged to declare the income that they recieve. This includes income arising

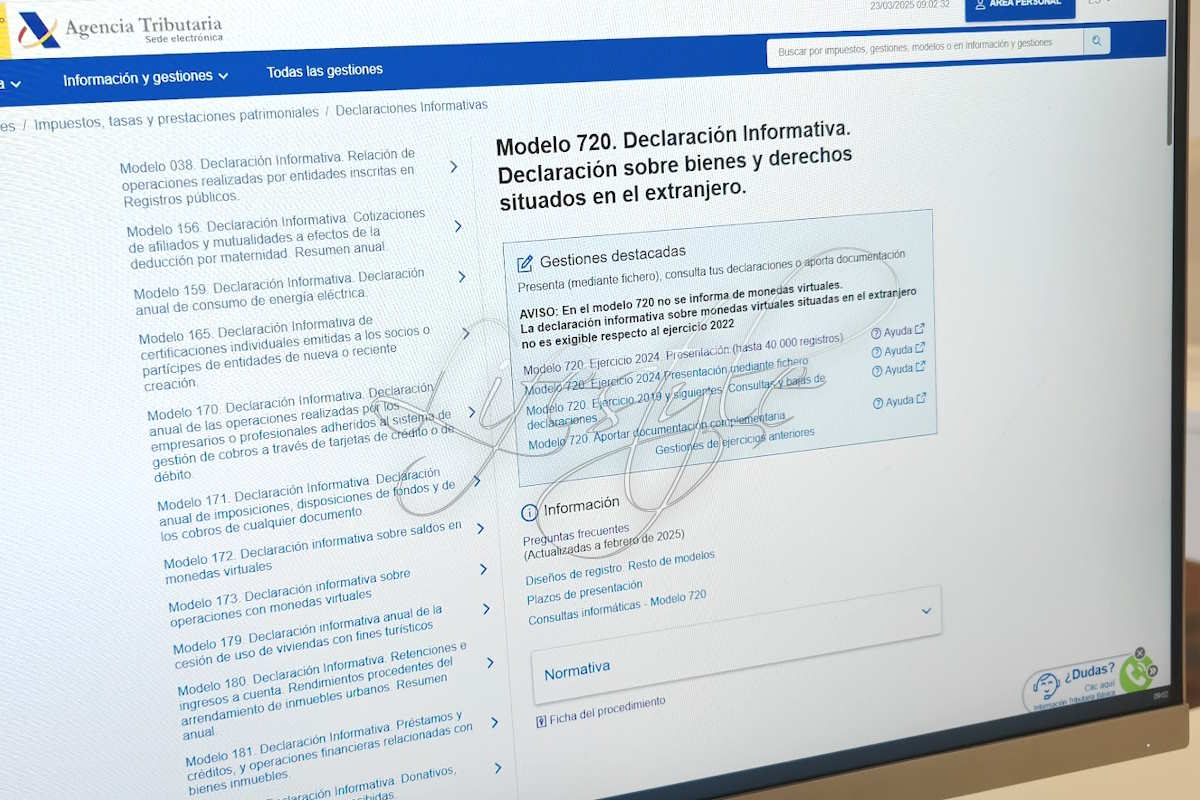

Modelo 720 Overseas Assets Declaration FAQ’s

1. What is Modelo 720? Modelo 720 is a mandatory tax form in Spain for tax residents to declare assets held outside Spain if they are above a certain value. 2. Who is required to file Modelo 720? Any individual or entity that is a tax resident in Spain and holds assets abroad exceeding the

Moving to Spain – Your First Tax Declarations

After moving to Spain your first tax declarations are due the year after you become tax resident in Spain. The tax year in Spain runs with the calendar year, 1st January to 31st December and the basic rule is that you become tax resident when you’ve spent 183 days in the year in Spain. Your

Spanish Residency & Planning for Tax in Spain

Understanding and planning fiscal residency and Spanish tax is a very important when making the transition to become a resident in Spain. Tax in Spain is very different to the UK, and has become even more complicated since the UK left the EU as the way certain types of income are treated changed. Here we

ETIAS Visa Waiver UK Passport Holders and Travelling to Spain

Update 10th March 2025 ETIAS will start operations in the last quarter of 2026.No action is required from travellers at this point.The European Union will inform about the specific date for the start of ETIAS several months prior to its launch. Source – the Officical ETIAS Website: https://travel-europe.europa.eu/etias_en So, no change for some time yet,

Getting Your Tax Right – Moving from the UK to Spain

Getting your tax right when moving from the UK to Spain requires an understanding of all the things that need to be done and when to do them. Here we provide information about all the things you may need to do or consider to make sure you get your tax right both on the UK

Moving to Spain Rule and Law Changes 2025

In 2024 Spain implemented significant reforms to its immigration laws to enhance migrant integration and address labour market needs. Key Spain rule and law changes that are relevant to people that are not citizens of EU countries who are looking to move to Spain include: Property Investor ‘Golden Visa Residency In November 2024, the residency scheme

Spanish Residency Requirements for British Citizens and UK Nationals 2025

British citizens / UK nationals now have to follow the same process as other non-EU national citizens of third countries to get Spanish residency, i.e. there is a requirement to first obtain a visa. The financial means required for a British Citizen / UK national to obtain a residency visa, is a lot higher than

The End of The Spanish Golden Visa

UPDATE In November Congress approved a bill that included text to scrap the ‘Golden Visa’ and end this residency scheme as soon as January 2025. On December 2nd, the Senate vetoed the bill sending it back to Congress delaying the ending of the Golden Visa for property purchases in Spain for several months. The legislation

Spanish Non-Lucrative Visa for UK British Nationals

The Spanish Non-Lucrative Visa offers residency to British nationals who have the financial means to support themselves without working. The Spanish Non-Lucrative Visa scheme is therefore ideal if you are retired, or have passive income, for example income from rental properties or other investments. The Spanish Non-Lucrative Visa is intended for full-time residency in Spain,

EU Travel Rules For Non-EU Family Members of EU Citizens

The EU travel rules for non-EU family members of EU citizens are different to the general rules for other nationals of non-EU countries. If you are a citizen of an EU country living in or or travelling to another EU country, your family can join you, including core family members who are not EU citizens.

Spanish Residency for non-EU family members of an EU citizen in Spain

Spanish residency for non-EU family members of an EU citizen in Spain, is an extended right. Family member includes spouse or civil partner, children or dependants of who are part of the household, and under 21 years of age. A citizen of an EU country has an automatic right to live in Spain, however must

Spanish Consulates in the USA

There are nine Spanish Consulates in the USA including Puerto Rico. The Consulates of Spain in the United States of America provide a number of legal and administrative services to both Spanish citizens and those intending to travel to or do business with Spain. This includes processing long term visa applications such as the non-lucrative

Spanish Non Lucrative Visa for Retirees Who Want to Live in Spain

The Spanish Non-Lucrative Visa offers residency to nationals from non-EU countries who have the financial means to support themselves without working. The Non-Lucrative Visa residency scheme is therefore ideal if you are retired or have passive income, for example rental income from properties or income from other investments. The Non-Lucrative Visa is for people who

San Juan

San Juan is a festival celebrated on the night / morning of 23rd / 24th of June. A magical night that welcomes the summer season, the celebrations take place during the shortest night of the year; the summer solstice. The festivities are usually held on the beach with friends around bonfires with drinks, food and

Tax in Spain for Residents and Non-Residents

Understanding tax in Spain is essential, not just if you live here, but also if you own a property in Spain. The Spanish tax year runs from 1st of January to 31st December. Residents have to complete their income tax return, declaracion de la renta, by 30th of June the following year, and non-residents have until

British Mums in Spain Get Two Mothers Days

Aside from the sunshine and many other perks of living in Spain, British mums can enjoy two special days every year. Today is mothering Sunday in the UK, and people and families all over the country will be appreciating their mothers and treating them to a special day. In Spain the equivalent day, ‘el dia

Processionary Caterpillars – Marching in March

Processionary Caterpillars, the larvae of the Pine Processionary moth,(Thaumetopoea pityocampa), usually start emerging February to April onwards. So by March they will typically be getting their marching in full swing. However with the mild winters we’ve been experiencing in their range in Southern Spain, processions are being spotted in some parts a lot earlier, frequently as early as

Spain’s Digital Nomad Visa for Remote and Online Workers

Spain’s Digital Nomad Visa and Residency is now more than two years old and has become the second most popular Spanish residency after the Non-Lucrative Visa. This visa or residency permit allows the holder to live in Spain and work remotely or online. It can be applied directly in Spain, or via the Spanish Consulate

Spanish Non-Lucrative Visa Applications in the UK handled by BLS International Visa Centres

All three Spanish Consulates in the UK have outsourced handling of Non-Lucrative Visa applications to BLS International. The consulates in London and Edinburgh were the first to make the switch at the start of summer in 2023 at the onset of Student Visa application processing. Manchester consulate continued handling Non-Lucrative Visa applications in house, though

The Requirements and Costs for British Nationals to Get Spanish Non-Lucrative Visas

It’s now the beginning of the 4th year since the UK left the EU changing the requirement and costs for British nationals to get residency in Spain. British nationals apply for a Spanish residency visa if they want to live in Spain, and by far the most popular is the Non-Lucrative Visa. We initially published

Spanish Consulate London and BLS International Visa Centre

The Spanish Consulate in London covers the southern counties of the UK, Crown Dependencies and British Overseas Territories. So if you live in East Anglia, the South East or the South West, you’ll take your application to the BLS International Visa Centre in London which handles visa processing for the Consulate of Spain in London.

Spanish residency for a non-EU family member of a British national who is resident in Spain under the withdrawal agreement

The withdrawal agreement guaranteed EU rights for British citizens and UK nationals that were legally resident in Spain before ‘Brexit’, and a special residency card was introduced. The withdrawal agreement TIE,tarjeta de indentidad de extranjero, for resident Brits in July 2020. The ‘Brexit’ foreigner’s ID card recognises the holders pre-Brexit rights and most British citizens

Spanish Consulate Manchester and BLS International Visa Centre

The Spanish Consulate in Manchester covers Central UK. So if you live in the Midlands, the North West, Isle of Man or Wales, you’ll take your application to the BLS International Visa Centre in Salford Manchester, which handles visa processing for the Consulate of Spain in Manchester. Locations that come under the Spanish Consulate in

Register a UK Car in Spain

The UK is no longer in the EU and the process and costs to register a UK car in Spain are a lot more than they were before Brexit. This is because UK cars now are now treated as vehicles from third countries and must clear customs, have import duty and VAT paid, or get

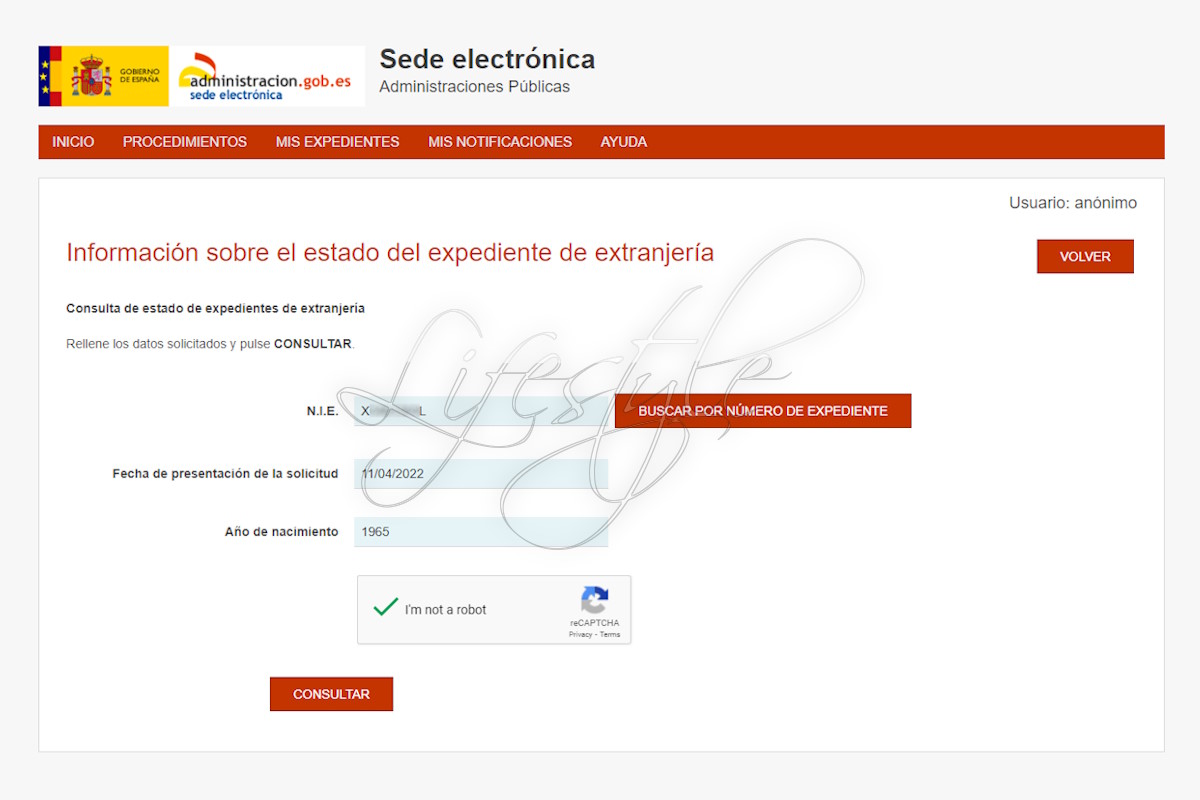

How to Check the status of Your Non-Lucrative Visa Application

Now that BLS International have taken over processing of Non Lucrative Visa Applications, it is no longer possible to track your application through the Spanish Consulate portal. BLS have their own tracking system and in addition to this your can also check the progress of your residency application on the Spanish immigration website.

Document Translation Certifying and Legalisation

Fortunately these days, if you don’t know the Spanish language, translating basic documents is relatively easy. There are abundant translation apps such as the popular Google Translate which a quite accurate. Of course, if you need to have a Spanish translation of a more detailed or official document, you’ll need to get someone to do

Spanish Consulate Edinburgh and BLS International Visa Centre

There are three Spanish Consulates in the UK that issue Spanish residency visa. The Spanish Consulate in Edinburgh covers the North of England, Scotland and Northern Ireland. So if you live in one of these areas, you’ll take your application to the BLS International Visa Centre in Edinburgh which handles visa processing for the Consulate

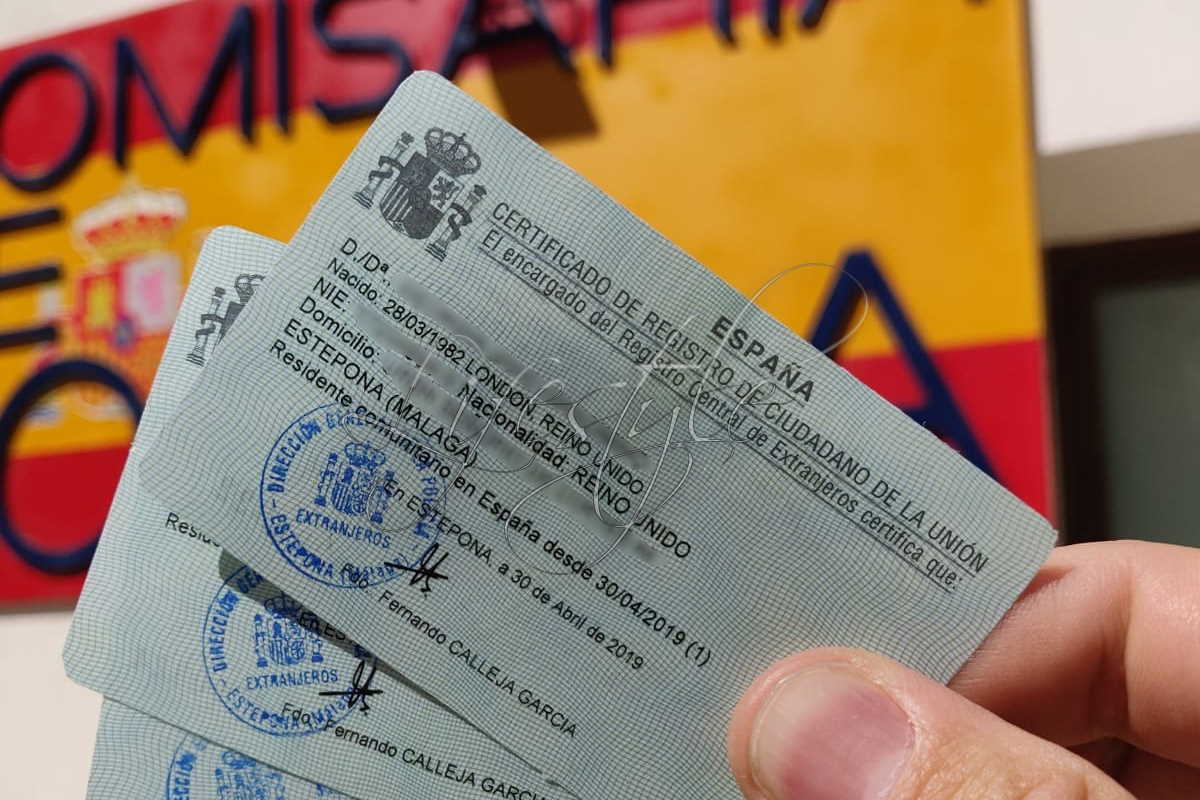

Spanish Residency Certificate for Citizens of EU Countries

Spanish Residency Certificate for Citizens of EU countries All EU and EEA (European Economic Area) citizens and their family members have the right to visit, live or work in Spain. A Spanish residency certificate confirms your status as a resident in Spain. For stays of up to 3 months there is no need to register

Register a Car from an EU Country in Spain

There are a few steps involved in the process to register a car from an EU country in Spain. Fortunately because of European standardisation, or homologation as it’s known, in most cases, provided you know the steps, it’s relatively straight forward. To begin with you will need to have an address in Spain. the registration

Spanish Golden Visa for UK British Nationals

The Spanish Golden Visa offers residency to individuals who make a real estate investment in Spain of €500,000 or more. The Spanish Golden Visa scheme has been in existence since September 2013 when legislation for the ‘residency by investment scheme’ was passed. The aim being to attract foreign investors at a time when the economy

Getting a good deal on Currency Exchange

When buying holiday money or sending money abroad, many banks and brokers include hidden fees and or a mark-up in the exchange rate. Not surprising, a recent study into international money transfers and payments found that 75% of consumers do not know about, or do not understand currency exchange rate mark-ups. In recent years specialised currency

Portugal Ends It’s Golden Visa Residency for Property Investors – Will Spain Be Next?

Portugal has ended its Golden Visa residency program for property investors. This announcement came just a week after Ireland terminated of its ‘Golden Visa’ Immigrant Investor Program. Both countries introduced Golden Visas in 2012, as did Spain, as they struggled to recover from the global financial crisis. The aim was to prevent banking collapse by

Spanish Residency Certificates Visas & TIE

If you’re not a Spanish citizen and want to live in Spain, you have to obtain Spanish residency. The process that you have to follow to get Spanish residency depends on your nationality, whether you are from an EU country, and if not, what you plan to do whilst you are a Spanish resident. Nationals

You must be logged in to post a comment.